Partnerships in Business

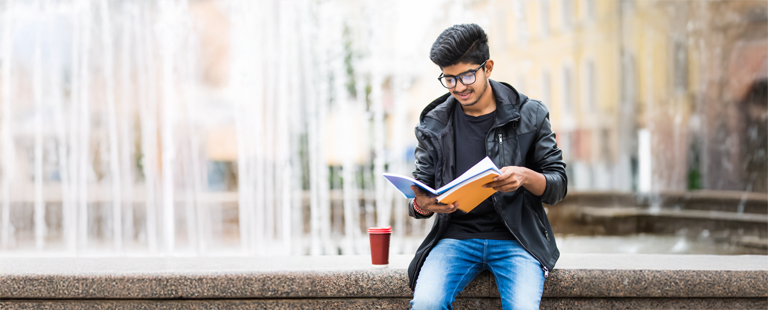

Before the initiation of an organization/enterprise, the first and foremost characteristic to consider is the type of business you wish to run. It can range from a sole proprietorship, Limited Liability Company, Corporation to Partnership. This selection can be done by considering factors such as business structure, rules/regulations, legal framework, number of members, etc.

What is partnership?

A partnership is a type of business structure wherein two or more parties, called partners, come together, with a business motive, to form and commence a business and further contribute in terms of capital, labor, skills, and experience. They distribute the responsibilities amongst themselves and share the profit/losses that the organization generates. The Indian Partnership Act is a legislation Act that looks over all the business partnerships in India. It lays down the required foundation, and framework which is needed for the formation, operation, and dissolution of the partnership.

Before the commencement of the business, the partners come together to discuss the terms & conditions, capital contribution, profit distribution, decision-making, etc. These conditions are further put into a legal document termed the Partnership agreement that incorporates the above-mentioned categories and lays down the base for how the business will be run throughout the years.

Some examples of famous companies that have entered into a partnership are Hewlett-Packard, Google, Ben & Jerry’s, PayPal, Subway to name a few

What are the types of Partnerships?

General Partnership: A general partnership primarily includes two or more partners who run a business and possess equal rights and representation. They can all, together, participate in managerial activities and decision-making and also exercise control over the whole business. In this type of partnership, the partners are given an equal share of profits and losses. Apart from this, the partners possess unlimited liability for the debts of the partnership. If one partner of the business is sued, the others also are held liable and their assets may be held and seized by a creditor/court. This is the reason; many businesses do not opt for this kind of partnership.

Limited Partnership (LP): A limited partnership consists of both general partners and limited partners who hold different levels of liabilities. The general partner here has unlimited liability and simultaneously manages the other (limited) partners. On the other hand, limited partners have very little control, which is restricted to the investment they have made. They are not given the authority of handling the day-to-day activities of the business. This is a very viable and fetching option when one wants investors who will financially provide for the company but do not wish to deal with responsibilities relating to the management of the firm.

Limited Liability Partnership (LLP): LLP is a type of partnership wherein all the partners of the firm possess limited liability, which depends on the share of investment they put into the venture. The partners all get their respective share of profits whilst making use of the confined and limited liabilities. No one partner will be responsible for the wrong-doings of the other partner, as each would be held accountable for their faults in this kind of partnership.

A few reasons why some businesses go for a Partnership structure due to the following

- Partnerships do not need to pay income tax but rather distribute the profits/ losses that are incurred on their business to the partners. The partners include their share on their tax returns.

- Vast availability of experience and skills on board which aids in the efficient management of the business.

- As overhead expenses are quite tough for starting up a new company, splitting the costs amongst the partners is a more feasible option.

- Conversion of a partnership to a limited liability company (LLC) can be done with ease. Thus, it is a straightforward procedure to convert to other business structures.

- The members of a partnership do not need to be concerned regarding other external decision-makers as the decision-making, ownership, and control are all in their hands.

Other advantages include confidentiality, privacy, ease and fewer formalities, combined decision-making, better work-life balance, improved expansion opportunities, and productivity.

Conclusion

To conclude with, choosing a partnership type of business structure gives rise to various advantages such as low establishment costs, ample contribution of each partner’s expertise, controlled decision making, more resources and effort, flexibility. The advantages show that picking a partnership would reap more benefits than others. Companies such as Warner Bros., LinkedIn and Walt Disney have a Partnership mode of business structure. These companies have an edge over the rest due to the vast resources, shared competence, risk bearing factor, and extended access to the market, interdependent skill sets, shared costs and benefits. The companies are where they are today due to their firm foundation and business structure and have reaped benefits for the same.

![Arm_Yourself_with_Deep_Business_Knowledge_&_Insights_with_PhD_Program_in_Business_Administration_at_Mahindra_University[1] Arm_Yourself_with_Deep_Business_Knowledge_&_Insights_with_PhD_Program_in_Business_Administration_at_Mahindra_University[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/Arm_Yourself_with_Deep_Business_Knowledge__Insights_with_PhD_Program_in_Business_Administration_at_Mahindra_University1.jpg)

![Emerge_as_a_Forward_thinking_Mechanical_Engineer_with_B_1140x460[1] Emerge_as_a_Forward_thinking_Mechanical_Engineer_with_B_1140x460[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/Emerge_as_a_Forward_thinking_Mechanical_Engineer_with_B_1140x4601.jpg)

![B.Tech_in_Computer_Science_Engineering_(BTech_CSE)_Your_Gateway_to_Become_a_Computer_Genius_1140x460[1] B.Tech_in_Computer_Science_Engineering_(BTech_CSE)_Your_Gateway_to_Become_a_Computer_Genius_1140x460[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/B.Tech_in_Computer_Science_Engineering_BTech_CSE_Your_Gateway_to_Become_a_Computer_Genius_1140x4601.jpg)

![Digital_Marketing_is_Booming_Globally_1140x460[1] Digital_Marketing_is_Booming_Globally_1140x460[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/Digital_Marketing_is_Booming_Globally_1140x4601.jpg)

![MU_Electrical20Computer20Engineering_1140x460[1] MU_Electrical20Computer20Engineering_1140x460[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/MU_Electrical20Computer20Engineering_1140x4601.jpg)

![BA_LLB_Hons_Course_at_Mahindra_University[1] BA_LLB_Hons_Course_at_Mahindra_University[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/BA_LLB_Hons_Course_at_Mahindra_University1.webp)

![Management_&_Business_Administration_is_Tremendously_High[1] Management_&_Business_Administration_is_Tremendously_High[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/Management__Business_Administration_is_Tremendously_High1.jpg)

![whyistraining&placementcellimportant[1] whyistraining&placementcellimportant[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/why20is20training2020placement20cell20important1.png)

![TheDifferencesbetweenRights&Duties[1] TheDifferencesbetweenRights&Duties[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/The20Differences20between20Rights2020Duties1.png)

![sleep_deprivation[1] sleep_deprivation[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/sleep_deprivation1.jpg)

![SelfLoveBlogImage2[1] SelfLoveBlogImage2[1]](https://www.mahindrauniversity.edu.in/wp-content/uploads/2023/04/Self20Love20Blog20Image2021.png)